Imported instability: examining the causes of eurozone contagion

In light of the expansionary austerity debate in peripheral Eurozone, the conventional solution surrounding Eurozone’s recovery has been a call for fiscal adjustment. The idea supporting austerity arises from the viewpoint of recklessness of peripheral Eurozone governments and their extensive debt accumulation and crippling welfare states. Even though a certain level of fiscal profligacy and strong accumulation of debt were apparent in peripheral Eurozone (and it is certainly the main issue holding back its recovery), this was hardly the most important reason behind a strong and severe recession that struck these countries. The focus of the article will be on the spread of financial contagion onto the peripheral Eurozone economies, namely Greece, Portugal, Ireland, Italy and Spain.

The problems that occurred for the peripheral Eurozone economies can be described through three features they all shared: domestic preconditions and instabilities, current account deficits and the euro, and outside contagion from the US.

The first are local instabilities and the way these countries ran their economies in the wake of the crisis. This doesn’t in all cases imply budget deficits and debt accumulation, rather each country was characterized by specific conditions which endangered the sustainability of their economies. Ireland and Spain experienced a housing and construction boom and suffered an immediate impact of deteriorating housing prices and loss of construction jobs. Before the crisis, their fiscal position was fine, with decreasing debt and a balanced budget, but after bank bailouts (Ireland) and bankruptcies of the largest construction companies (Spain), decreasing revenues and increasing expenditures increased their budget deficit and public debt beyond sustainable. Portugal had over-expenditures into large public projects (including building stadiums for the Euro 2004), mismanagement in public services and investment bubbles which all led to a rising public debt and an unsustainable fiscal position. Greece and Italy, both on very sensitive high public debt levels before the crisis (see Figure 1) had an additional constraint – corrupt politicians who cared more of self-preservation than the well-being of their country. Their politicians used expensive populist policies to remain in power. They used cheep borrowing on the international market to fund their electoral victories by broadening its welfare states and offering concessions to particular electoral groups. They ‘bought’ votes by increasing pensions, hiring more public sector workers and increasing their wages in order to create a perception of high employment. Their governments were perfect examples of how the inflow of foreign capital was used inefficiently to finance consumption and maintain political power.

The second characteristic was the introduction of the euro. Due to a common currency it became cheaper for the peripheral economies to borrow on the international market which induced large current account deficits. This was the point of a single currency – to ease the movement of capital across borders. But what it created was a dependency on credit from abroad. Once this credit flow stopped the stage was set for the spread of the crisis. They found themselves in a typical sudden credit stop (as explained in Reinhart and Rogoff, 2009), usually a characteristic of emerging economies that pegged their currencies.

And third, what brought to the sudden stop of credit, worsening their fiscal balances, was the spread of outside contagion, particularly from the US. The financial crisis that started in the US quickly spread worldwide through decreasing trade and a loss of investor and consumer confidence causing a credit squeeze. All this made it harder for the peripheral economies to borrow on international markets, and since their economies became dependent on cheap capital from abroad to finance their consumption and government expenditures, the credit squeeze proved to be particularly painful. Outside contagion brought the domestic instabilities of the Eurozone economies onto the surface, and created the final trigger for the sovereign debt crisis.

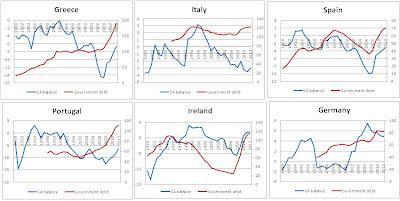

Figure 1: Eurozone countries’ current account balances and gross government debt (click to get a better view)

Observing Figure 1, a common feature is obvious: right before the start of the crisis, and mostly since the introduction of the euro, all peripheral economies experienced rising current account deficits, while the same period saw a large CA surplus in Germany. Even though Greece didn't have a CA surplus for over 30 years, Portugal, Spain, Ireland and Italy all experienced CA surpluses at some point prior to the introduction of the euro, only to see them decrease rapidly from the beginning of the decade.

Government debt increase, on the other hand, fails to give such strong implications. Spain, Italy and Ireland were actually decreasing their government debts and improving their fiscal positions, while Greece kept it steady. It wasn’t until the actual start of the crisis that the debt levels started rising in every country.

Therefore, fiscal profligacy isn’t as crucial as often made to believe. Some instabilities certainly did exist, but they couldn't have caused a crisis so severe and so widespread. It is more likely that outside contagion combined with dependence on foreign capital inflows exacerbated the systemic risk of each country. Domestic imbalances became more visible once the foreign inflow of credit stopped. They are now the cause of problems of structural adjustments, but they weren’t the cause of the contagion itself.

Instabilities from abroad: problems with a CA deficit and the common currency

When one country runs a current account deficit, this implies it runs a surplus in its capital account. A capital account surplus means an inflow of foreign capital into a country (foreigners buying more domestic assets) which is essentially a good thing since money will always flow to where it expects the highest and safest returns. However, the question is where is the money from abroad being transferred to domestically? If it is used to finance investment (into manufacturing, productivity increase or any other wealth creating activity) instead of consumption, then the deficit can carry on rising as the country is using the inflow of capital to boost its production facilities and increase growth. If it is used to finance consumption and government expenditures focused on politically popular policies, then the outcome might be an asset price boom or an unsustainable fiscal position of the government who is becoming dependent on foreign capital to finance its exaggerated expenditures. Ireland, Spain and to some extent the US suffered from the first, while Greece, Portugal and Italy suffered from the former.

Before the euro Greece had a history of debt defaults, financial contagion, inflation crises and banking crises (see Reinhart and Roggof, 2009). This was usually reflected in its higher bond yields – a risk premium for investing in its debt. The spread between Greek and German bonds was historically always high. However, once the euro was introduced, its yields and the spread started decreasing making the Greek debt as safe an investment (financially) as the German debt. The reasoning behind it was that the ECB would make sure inflation and currency instability will never again be the problem of Greece or any other peripheral country. Soon enough, every peripheral Eurozone bond on the market traded as the German Bund – the spreads were smaller and the risks were perceived as non-existent (Basel II recognized their debt as zero risk-weighted assets).

This meant one thing; all these countries could borrow at cheap rates, while its politicians had no need to be fiscally responsible and could resort to populist policies that would keep them in power. Borrowing cheaply meant that credit from abroad was used to fuel domestic consumption which led to a rapid increase in GDP above its potential levels, either through high government spending (Greece, Portugal) or housing market booms (Ireland, Spain).

Figure 2 observes how the inflow of capital was used in peripheral Eurozone. It compares levels of consumption, government expenditures and gross fixed capital formation (fixed investments) for each nation observed to evaluate the sustainability of the CA deficit.

(click to get a better view)

(click to get a better view)

Government expenditures also show a rising trend for each country (represented by the blue line). For all the countries government expenditures were closing the gap between investments. In Spain they grew simultaneously with investments, while in Ireland they grew simultaneously with consumption. In Greece, they grew rapidly, doubling in absolute terms over the past decade, while Portugal experienced a significant decrease of the gap between investments and government expenditures after the introduction of the euro.

Summary of outside contagion

Interest rates were low across the Eurozone, and investors in core countries seized this opportunity to invest in periphery economies. In Germany lack of domestic demand was substituted by investing abroad. It became more attractive to invest in the periphery as the risk of default was diminished by the fact that the euro was backed up by all Eurozone nations. Capital outflows came mainly from the core as it became available for German and French investors to broaden their portfolio onto new, yet stable markets. The system of borrowing to fuel domestic asset bubbles worked as long as the asset prices kept rising. Borrowers could pay off their loans simply by borrowing more even cheaper. The problem arose when the inflow of capital suddenly stopped due a spread of the US financial contagion across the globe. Investor confidence rapidly declined worldwide and the peripheral Eurozone countries faced the same fate of the Latin American countries in the 90ies, since they were no longer able to issue debt in their own currency. Investors didn’t react well to this. The sudden stop in 2009 made it difficult for these countries to roll over their debts which increased the European crisis of confidence and led the peripheral economies into a sovereign debt crisis.

Essentially the idea of the euro was to increase and smoothen convergence in the Eurozone. Adoption of the euro made it easier for capital to flow into the peripheral countries. Their CA deficits prove this. However, this was an anticipated reaction and a welcomed move from the Eurozone policymakers. It indeed helped fuel and sustain economic growth way above its potential level for some of these countries. It was supposed to be used to make their economies more competitive. But consumption and government expenditures (and an asset price bubble in Ireland and Spain), rather than investments, were fuelling growth creating dependency on foreign capital to service current liabilities. An increase of systemic risk and asymmetric outside shocks that led to a stop of credit exacerbated the existing instabilities in peripheral Eurozone.

See the full analysis, including the outcomes and the consequences here.

To further understand the "imported" component of the crisis, it is important to recall that the deficits are made possible by the financing from the exporting country banks, as they recycle the export surplus. That's why German banks had record leverage, while the Bundesbank looked the other way.

ReplyDeleteSee Testing the Limits of Divergence in the Eurozone in the blog PPP Lusofonia http://ppplusofonia.blogspot.com/2011/12/eurozone-crisis-tests-limits-of.html

Excellent point, I agree.

DeleteAnd the reason they had record leverage can again be traced to the effects of monetary convergence and the leveling of bond yields across the continent. In addition bonds across the eurozone were given a zero-risk investment grade, thus encouraging the banks to invest in it and fill up their balance sheets with peripheral debt. This is the main reason of bank contagion (I covered that in the full analysis, available here under title I.4)

This was essentially how the CA deficits were financed - banks in exporter countries bought cheep peripheral debt.

This is a very good point; if I understood it well, it was a lethal combination of domestic profligacy (both private and public) which was strengthened by large current account deficits and low bond yields that just made borrowing a bit more easier than usual. So the people were overconsuming and the governments overspending, which meant that the CA balances were more dangerous and highly unsustainable. All it needed was a credit crunch to go straight downhill.

ReplyDeleteSo is your argument in favor of the reform and austerity measures, or something else? Cause the way I see it the GIPSIs can't take all the blame, some of it was brought to them by Germany indirectly. So it's not really fair what the Germans and other Euro export nations are requiring from them. It should be OK for Germany to also take on some blame and share the burden of the crisis. The GIPSIs weren't angels, but neither were the rest of the eurozone.

Thank you, I'm happy you found the analysis useful.

DeleteMy argument is for the more than necessary reforms, but those aimed at growth and restructuring of the domestic economies. What Italy and Spain are doing right now seems to be producing positive signals and good results, amid some unavoidable protests, but good results nonetheless. Some announced structural reforms may constrain their economies momentarily, but this needs to be done in order to respond to the market signals of the need to rebalance their economies. The structural imbalances of the domestic economies were obvious well before the crisis (as I state in the text), and all this distorted market signals and led to a huge misallocation of resources. This needs to be dealt with to set stage for growth in an economy. Now is a painful time of doing so, but no one wants to do an unpopular thing like this when times are good. Simply for political reasons. That's why in good times, structural problems are ignored, but in times of crisis they must inevitably be taken care of. And surprisingly it's easier politically to do now.

I wouldn't agree that it's easier to do it now for politicians. This is why several governmnets have lost elections since the beggining of the crisis. Iceland, Ireland, UK, Spain, Italy, Portugal, Greece - they've all lost office since the start of the crisis. The latest cases of Italy and Greece point it out more obviously than any other example. They were thrown out cause of unpopular reforms. I'm not sure the Cameron government would survive either if there was an election in the UK

DeleteAll these governments lost office during the crisis, not while reforming. In the UK, Ireland and Iceland, the governments lost office due to their incompetence to deal with the crisis, and their consequential destroying of the public finances. In fact, the Irish government probably single-handedly brought the country into a sovereign debt crisis, while the UK government severely increased the deficit and the debt, placing a huge burden on the next government to resolve it.

DeleteItaly and Greece on the other hand are hardly the examples of reformist governments (just remember Berlusconi). They were opposing tough reforms and were replaced by technocratic governments - even though not being voted for officially, they were the best possible solution at the time (and still are).

Spain and Portugal also saw the rise of parties who promised to take on more reforms and cuts.

My point was that it's easier to pass unpopular policies in times of crisis than it is in times of prosperity, where any wrong policy, no matter how necessary it is, will result in loss of power. Currently, a majority of the people realize this is needed and they go on with it.

As for the UK election, the coalition would still win, in fact, it would probably be an even stronger win for the Tories due to a ridiculous Labour opposition, and a severe decrease of popularity for the LibDems.

I agree with Vuk, it is easier to constitute a reformist government in times of crisis. The people are much more likely to accept this now, as the current media is over-blowing the whole picture of instability and a need to react quickly. Sure, there will always be opposition to cuts, but the majority will accept them as a necessary medicine.

DeleteBtw, yes, the Tories would probably get a win to create a single party government

@Charlie, you're obviously a Tory, so you're a bit biased. I for one, don't think they would win, and here are the facts to prove it: http://www.guardian.co.uk/news/datablog/2009/oct/21/icm-poll-data-labour-conservatives

DeleteThe voters quickly forgot the Cameron EU snub which kept the Tories well off just for about a month or so. And there's no chance for a single party government either

@Vuk, it's never easy to do unpopular policies - it wasn't easy in 2008 or 2009, so it was postponed, and those who tried to reform were kicked out. The same will happen to the technocrats and all other austerity-bound governments, particularly the UK.

And you're obviously a Labour lefty, so there's no point in further discussion. We'll just wait and see who wins the general election. Here's a hint, it certainly won't be Ed Miliband.

DeleteI think we're digressing from the main point here. The text was on eurozone contagion, it didn't involve any British politics.

DeleteBesides, please refrain yourselves from any insulting or negative comments. I have a feeling this would continue into a political argument, and I would like to avoid that.

Thank you!

Financing consumption and government spending with current account deficits is never a good idea. It only results in more debt. Both consumers and governments are encouraged to take on debt because of low interest rates and low bond yields (since this is essentially what drives capital into a country)

ReplyDeleteThe same thing happened in the United States - the historically high CA deficit proved to be too big to handle. It probably had a major input in the housing bubble as well.

The credit cycle, "overlending, bubble, crash, debt workout" is historic and well known. When the lending is cross-border, it feeds trade and current account imbalances. Back in the 1970s, New York money center banks were recycling "petrodollar" from newly rich OPEC countries to oil importers like Brazil.

ReplyDeleteWhen the surplus country creditors lend too much, they must share the sacrifice by forgiving some debt while the partners impose austerity to increase repayment capacity.

This is standard Debt Workout 101 http://ppplusofonia.blogspot.com/2011/09/debt-workout-101-games-borrowers-and.html

What doesn't make any sense is for local savers and depositors to be asked to take a haircut on their own sovereign debt, as is happening in Greece. If you penalize local savings, where will the future repayment capacity come from?

that is true, local savings shouldn't be punished this way.

DeleteHowever, my point on banking differs, as I don't see why surplus country banks should share the sacrifice of misguided regulatory decisions. At the end they will have to since Greece's 'controlled' default will impose significant losses on the surplus country banks which have invested in peripheral debt guided by the Basel standards - see more in this post.

At the end, most of these losses will be carried over to the taxpayers in every eurozone country that is 'sharing the sacrifice'.

Pity not the creditors, nobody forced them to lend.

ReplyDeleteEven if the Basel and central bank (im)prudent allowed it, there were some very highly paid people in those credit and invesment committees.

If most of the bad cross-border were made by German, British and French banks, in that order, which should the losses be taken by the taxpayers of all 27 countries?

This is MORAL HAZARD writ large. http://ppplusofonia.blogspot.pt/2012/06/us-and-uk-banks-increased-potential.html

Government debt increase, on the other hand, fails to give such strong implications. Spain, Italy and Ireland were actually decreasing their government debts and improving their fiscal positions, while Greece kept it steady. It wasn’t until the actual start of the crisis that the debt levels started rising in every country. Keep on sharing.

ReplyDeletecapital Accounts Collections

True, that's why the emphasis in the text is on the sustainability of the CA deficit of the mentioned countries. This is something they all had in common.

DeleteIt really is tricky in order to picture a business more technical and up licensed as opposed to scan upload organization. Because you well realize in case you are a part of this specific euroexport enjoyable business, it includes numerous profitable gains in order to those who're prepared to perform lengthy sufficient, tricky sufficient as well as clever sufficient.

ReplyDelete