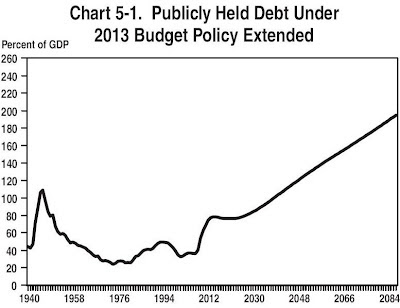

US debt and deficit - graph of the week

From the latest US budget proposal, I found an interesting graph that was given attention to in Congress.

|

| Source: US President's Budget for Fiscal Year 2013. Analytical Perspectives, pp. 58 |

It describes a long term fiscal challenge facing America, where the current administration (led by the Treasury secretary Mr Geithner) stresses the importance on short-term deficit control and debt reduction, something vehemently opposed by Paul Krugman.

The idea is to decrease the short term deficit and decrease the growth rate of the public debt by the end of the decade. The deficit is projected to be around 2.8% of the GDP by 2019, which is a goal within reach.

"Beyond 2022, however, the fiscal position gradually deteriorates mainly because of the aging of the population and the high continuing cost of the Government’s health programs." Analytical Perspectives, US Budget (February 2012), pp.58

These expected costs will drive up the deficit and cause a huge increase of the public debt in the next 50 years. Mr Geithner stresses out how this graph describes the two-way approach of the administration; one to take care of the short-term deficit, and the other where they apparently don't care on the long-term sustainability of their solution, rejecting other views cause they "don't like it".

Now, even though the projections can be biased and shouldn't be completely trusted (as it's unlikely that the debt could grow so big in the course of the next 50 years - there is always an upward bias in forecasting models) it does show a unfavourable trend for the US public finances.

Even more surprising is the reason why the current administration decided to reject the proposals made by their own non-partisan fiscal commission. In fact, here is how the Bowles-Simpson report projected the movement of the US debt under three scenarios:

|

| Source: "The Moment of Truth" National Commission on Fiscal Responsibility and Reform. December 2010, pp. 10. |

Pay attention to the blue line denoting the Commission proposal's debt levels for the next 30 years. From comparing the two graphs it seems that the current budget proposal chose the current policy scenario (green line in the second graph), only smoothing it a bit until 2020, and then letting it rise unsustainably.

Furthermore, where the current budget proposal finds no way of eliminating the deficit (the aforementioned 2.8% is the lowest it can go), the Bowles-Simpson report actually does manage to get the deficit under control and seriously decrease the public debt.

|

| Source: "The Moment of Truth" National Commission on Fiscal Responsibility and Reform. December 2010, pp. 16. |

Perhaps the current administration is worried about the upcoming elections later this year and doesn't want to engage into necessary entitlement cuts and the welfare state reform, which is a sad motive to be guided by, at least for the economy.

I really really hate this, but there is only going to be one answer (well several answers)to our future problem. Curtailing the growth of the entitlements is important.

ReplyDeleteBut the big solution I see is going to be sales or VAT taxes. I hate the prospect. But it is the only way I see to allow the government to reclaim some of the income of all the many millions of retired people.

Most people when they retire end up paying little or no income taxes. That, combined with the cost of their medical care and pensions will ruin the country unless we can get some of that money back.

Even if government becomes a whole lot more sane and begins to radically cut spending, it won't be enough.

I see your point - choose the lesser of two evils :)

DeleteThe expected rise of entitlements really makes you wonder how will all this be financed. And in that sense I agree, the best way to fund a welfare state is a VAT or a sales tax.

However, let me just draw your attention to a good article in the WSJ by Dan Mitchell - he opposes the VAT strongly. His argument is essentially that the VAT is a road to bigger government and a welfare state Europe.

So my response would be not to think how we can finance the welfare state, but to put a stop to it until it's not too late. Unless it really is too late.

Spoken like a true COMMUNIST.Those retired people EARNED their pensions, retirement plans, and SS. You wouldn't possibly consider elimination of foreign aid, or at least drastic reduction would you? How about doing away with OBAMA PHONES? How about elimination of DISABILITY FROM SS? It was not intended for 40% of the population to be on it. How about EVERY ONE PAYS 10% INCOME TAX? HOW ABOUT DRUG TESTING FOR ELIGIBILITY FOR WELFARE? HOW ABOUT ELIMINATING FOOD STAMPS? HOW ABOUT ELIMINATING SCHOOL LUNCH/BREAKFAST PROGRAMS? THATS WHAT PARENTS ARE FOR!! HOW ABOUT PEOPLE GETTING OFF THEIR ASSES AND GOING TO WORK?

Delete