India's new central banker

Raghuram Rajan, a notable economist from the University of Chicago and author of the famous "Faulty Lines" book on the financial crisis, is to be appointed as the new governor of the Bank of India. Certainly a role he's more than capable of. He joins a whole line of notable academic economists that ended up in policy - such as Stanley Fisher in the Bank of Izrael, Ben Bernanke in the Fed, Joe Stiglitz in the World Bank, Christina Romer, Larry Summers (also a potential Fed governor), Timothy Geithner, Greg Mankiw and a whole number of others at the Council of Economic Advisers (which isn't really that surprising). Some of these were more successful at their policy roles, some less, but they all proved the importance of having a renowned academic expert (say, a technocrat) to give advice or directly control some of the nations main economic institutions. I have no doubt that prof. Rajan will be successful in his position. After all, the pressure in India will probably be much less than at any US policy institution, despite the troublesome economic climate. On that line, here is a list of countries who should take note - countries which have a lot of world renowned scientists working abroad who would be more than successful in improving the efficiency of their domestic economies. Italy and Greece already tried it, but their electorates have failed them.

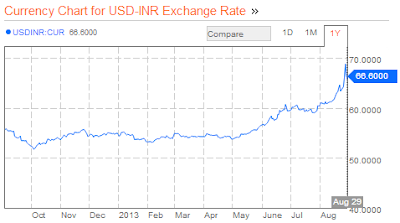

Anyway, the current state of India's economy is troublesome. Despite a decade of strong economic growth, it accumulated a record current account deficit, is facing a high inflation, a plunging currency (the rupee is off 20 percent against the dollar making imported food and oil more expensive), with economic growth slowing down threatening to downgrade the government's bond rating. The Central bank earlier this year cut rates which further weakened the rupee, only to raise them back in July. A tricky situation indeed, where more aggressive Central bank stance on inflation and the currency will further cripple domestic economic growth.

|

| Source: Bloomberg |

Will Rajan be able to cope with all this? A few months ago he wrote an article for Project Syndicate, precisely identifying the problems India is facing right now. The first problem, he claims, are India's poor institutions and poorly defined property rights:

"...new factories and mines require land. But land is often held by small farmers or inhabited by tribal groups, who have neither clear and clean title nor the information and capability to deal on equal terms with a developer or corporate acquirer. Not surprisingly, farmers and tribal groups often felt exploited as savvy buyers purchased their land for a pittance and resold it for a fortune. And the compensation that poor farmers did receive did not go very far; having sold their primary means of earning income, they then faced a steep rise in the local cost of living, owing to development.

...strong growth tests economic institutions’ capacity to cope, and India’s were found lacking. Its land titling was fragmented, the laws governing land acquisition were archaic, and the process of rezoning land for industrial use was non-transparent.

...because India’s existing economic institutions could not cope with strong growth, its political checks and balances started kicking in to prevent further damage, and growth slowed."

The second problem was the financial crisis and a slow recovery in the developed world that triggered problems for emerging markets and their 2009 short term stimuli:

Rajan also offers his own idea of a "quick fix":"...as industrial countries, beset by fiscal, sovereign-debt, and banking problems, slowed once again, the fix for emerging markets turned out to be only temporary. To offset the collapse in demand from industrial countries, they had stimulated domestic demand. But domestic demand did not call for the same goods, and the goods that were locally demanded were already in short supply before the crisis. The net result was overheating – asset-price booms and inflation across the emerging world.In India, matters were aggravated by the investment slowdown that began as political opposition to unbridled development emerged. The resulting supply constraints exacerbated inflation. So, even as growth slowed, the central bank raised interest rates in order to rebalance demand and the available supply, causing the economy to slow further."

"To revive growth in the short run, India must improve supply, which means shifting from consumption to investment. And it must do so by creating new, transparent institutions and processes, which would limit adverse political reaction. Over the medium term, it must take an axe to the thicket of unwieldy regulations that make businesses so dependent on an agile and cooperative bureaucracy."

So, he suggests an institutional and political reform coupled with supply-side policies aiming to shift the focus towards savings and investments. Great stuff. However none of these factors will be his to influence. His role is to get a grip on inflation and the declining rupee, and hope he won't hurt growth too much. Good luck!

Problems are clearly supply-side. Rajan should be a major public figure pushing for reform acceptance in the public (dont know how is the public perception of the guvernor in India though)

ReplyDeleteMeanwhile, heres a nominee for your graph of the week

http://www.livemint.com/r/LiveMint/Period1/2013/09/02/Photos/g-economy_web.jpg

Greets!

Good one, thanks for the hint!

DeleteRajan is a great economist, but you're right, India's problems are beyond his scope as a central banker.

ReplyDeleteIndia is a good example of what I meant in the previous comment on emerging markets slowdown. Even though it isn't without problems, certain things have changed: the way people do business, the way transactions are executed, the general openness of the country, etc. Even nominating Rajan as the cb governor is a step in the right direction to preserve the pace of positive change. Don't get me wrong, a lot still needs to be done, but I do believe there is reason for optimism..

ReplyDelete